The value of non-ferrous metals, including copper, is well-recognized in both industry and the financial markets across different countries. Copper and its derivatives are among the most important products in financial and stock markets, with numerous transactions recorded around their buying and selling.

The excellent chemical properties of this metal, combined with its high electrical and thermal conductivity and superb malleability, have made copper one of the most widely used engineering metals. Therefore, the high volume of transactions surrounding this product necessitates being informed about its price.

Whether you are looking to invest in copper-producing companies or seeking to purchase copper at a suitable price as a producer, it is essential to have an accurate copper price prediction in the future to make the best market decisions. Join us as we analyze and predict copper price and the factors influencing this commodity’s pricing.

Factors Influencing Copper Prices

Although making an accurate prediction, especially in markets and transactions, is very challenging and sometimes impossible, by examining certain factors that affect market behavior, producers, and consumers, we can predict upcoming fluctuations to some extent.

This is also true when forecasting copper prices. The most important factors influencing copper prices are:

- Supply and Demand

- Copper Reserves

- Political and Economic Developments

- Export and Import Tariffs

- Fuel and Energy Costs

Supply and Demand

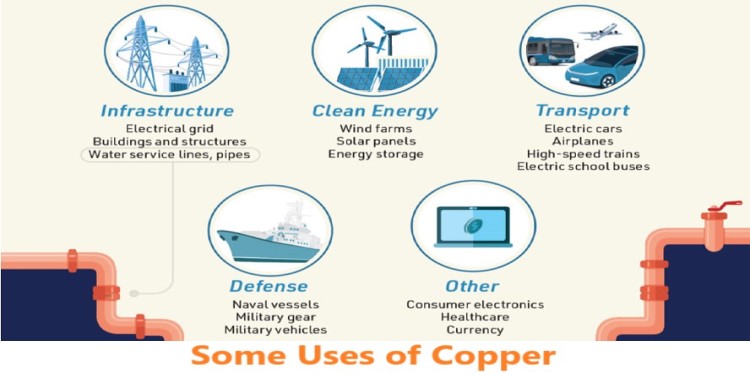

The first and most important factor in determining the price of copper is the balance of supply and demand for this product. A balance between supply and demand creates price stability; however, if this balance is disrupted, it will lead to a decrease or increase in copper prices. With the growing use of copper in manufacturing industries and technology development sectors, demand for this product has increased.

For example, electric vehicles use up to four times more copper than gasoline vehicles. Additionally, renewable energy industries require significant amounts of copper to build wind turbines and solar cells. Therefore, we can predict that with this increasing demand, copper prices will see a significant rise in the coming years.

Copper Reserves

Another factor affecting copper prices is the amount of copper reserves in the major producing countries. In 2024, Chile, Peru, China, Congo, and the United States were recognized as the top five copper producers globally, and the reserves in these countries significantly impact global copper prices. Additionally, we should not overlook the impact of exchange rates on metal pricing, even when discussing countries with the largest copper reserves.

Political and Economic Developments

Political developments, such as wars between countries, regional tensions, or disruptions in global economic conditions like those experienced during the COVID-19 pandemic, cause severe market fluctuations and significantly impact stock markets worldwide.

In such situations, exchange rates and global gold prices tend to increase, which in turn leads to higher prices for industrial products, minerals, consumer goods, and more. Many analysts view copper prices as an indicator of global economic activity, seeing it as a reflection of the interaction between supply chains and production sectors.

In stable political and economic conditions, we see global economic growth and expansion, which usually leads to increased demand for copper and consequently higher prices.

Export and Import Tariffs

Restrictive policies on export and import tariffs imposed by copper-producing or importing countries cause price fluctuations. Such conditions usually arise due to internal tensions, where export restrictions in copper-exporting countries lead to increased copper prices in countries demanding this product.

This is due to fears of reduced copper supply by producers and decreased production capacity. Conversely, an example of this was observed in recent years during tensions between China and the United States, which led to increased domestic costs for Chinese customers and a significant drop in copper prices in China.

Fuel and Energy Costs

Environmental organizations’ restrictions on industries and producers to use clean and renewable energy instead of fossil fuels increase production costs. Additionally, the rising exchange rate directly impacts fuel and energy costs, leading to higher production costs for copper.

Copper Price prediction for 2025

In May 2024, copper prices rose to $10,500 per ton, the highest recorded price since April 2022. The primary reason for this increase was the clean energy industrial policies in the United States and Europe, which rely on electrification, despite low copper reserves.

However, after reaching this price peak, copper prices started to decline, falling to $8,750 per ton by August. With the upcoming 2024 U.S. presidential elections, it is predicted that copper prices will continue to fall until after the elections, when new trends will emerge based on the elected candidate’s policies.

Although forecasts lean towards copper prices rising again after this event, it remains to be seen whether the historical peak recorded in May 2024 will be surpassed. Overall, the copper price prediction for 2025 suggests an upward trend.

Copper Price Chart in 2024

Up until mid-2024, copper prices have experienced fluctuations, with an average price of around $8,250. February marked the beginning of copper prices’ surge towards a peak. Due to the excessively high demand from copper-dependent industries, such as renewable energy and transportation, the price of this product skyrocketed, leading to a new price peak in May 2024, the first in two years.

However, after this month, due to a surge in global stock inventories and weak job data in the United States, the global copper price fell below $10,000 per ton, and this downward trend continues.

Copper Price History

The historical trend of copper prices from the second half of 2019 to the first half of 2024 shows that the global average price of copper, after a fully upward trend, fluctuated between $7,500 and $9,500 until it reached the peak of $10,500 in 2024.

After the end of the COVID-19 pandemic and the resumption of many industries, the high demand for copper combined with low supply caused a sharp increase in its price. Within about 18 months, the price of copper more than doubled from $5,000.

Additionally, the reduced copper supply during this period was directly linked to decreased production in China and the imposition of strict sanctions on Russian metal exports.

Summary

Analyzing copper price behavior in recent years shows that this product’s price can reach new heights. Despite the decline in copper prices during the first half of 2024, it is predicted that copper prices will experience an upward trend in 2025.

This is due to increased demand for copper following the growth of the energy and transportation industries and the upcoming U.S. presidential elections. Additionally, other factors influencing copper price fluctuations in 2025 will include regional and global political-economic changes, copper reserves at the end of 2024, fuel and energy costs, and the export-import policies of major producing and importing countries.