Iran is one of the largest producers and exporters of copper in Asia and even on a global scale. Due to the high quality of its copper products, they are highly sought after in international markets. Therefore, being informed about the market capacity and copper price in iran, its producers, mines, and the transactions conducted in global markets in relation to exports can be valuable for customers of Iran’s export copper market. If you are considering purchasing copper from Iran, we invite you to read this article about the current state of Iran’s copper market.

How Much Copper Is in Iran?

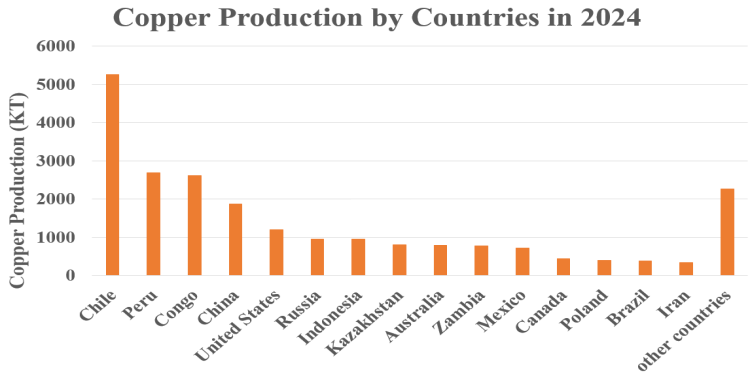

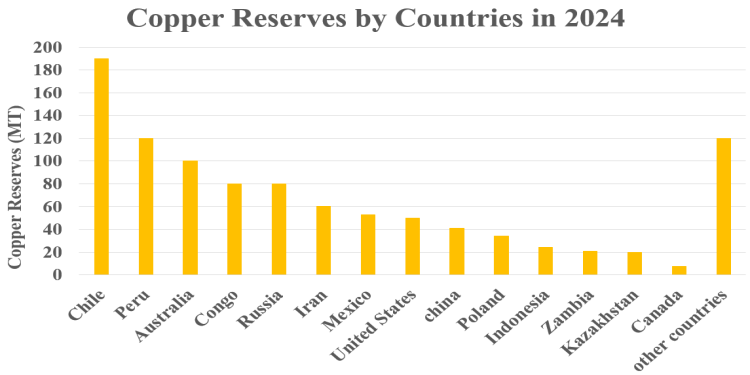

In 2024, Iran holds 6% of the world’s copper reserves, containing 60 million tons of copper, ranking it sixth globally. In terms of copper production, with an annual output of 335,000 tons, Iran accounts for 1.5% of the world’s copper production and ranks fifteenth. In fact, the ratio of copper production to reserves in Iran is 0.6%, which is the lowest among copper-producing countries.

Iran’s Copper Cathode Production

Regarding copper cathode or refined copper products, it should be noted that in 2024, Iran produced 321,000 tons of copper cathode, ranking 15th in the world, which accounts for 1.2% of global production. In Asia, Iran holds a 2.1% share of copper cathode production, placing it sixth on the continent.

List of Copper Mines in Iran

The most important copper mines in Iran are:

- Sarcheshmeh Copper Mine

- Qaleh Zari Copper Mine

- Miduk Copper Mine

- Chehel Kureh Copper Mine

- Ahar Copper Mine

- Aliabad Copper Mine

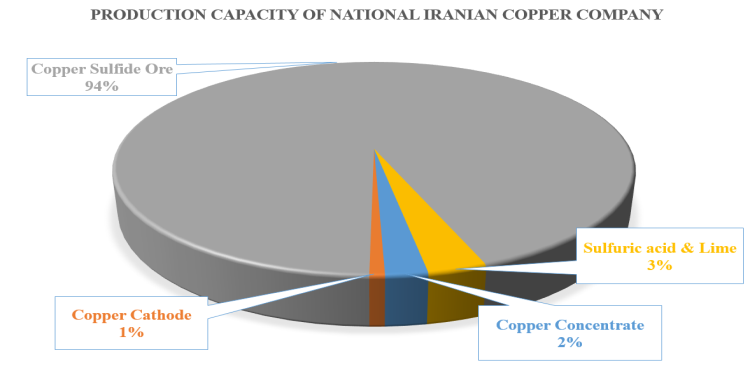

Among these, the Sarcheshmeh, Sungun, and Miduk mines are the largest copper mines in Iran, all of which are owned by the National Iranian Copper Industries Company (NICICO). This company primarily uses the pyrometallurgy method for copper production, mainly due to the large volume of sulfide copper ores in Iran, particularly in the Sarcheshmeh Copper Mine. Below is the production capacity of the National Iranian Copper Industries Company, broken down by product:

Statistics on Iran’s Copper Market

The volume of Iran’s copper exports has been variable, influenced by various factors such as domestic production, global prices, international market demand, and economic and political conditions. Iran exports a range of copper products, including copper concentrate, copper cathodes, and semi-finished copper products like wire and cable. The country exports its copper to various destinations, including China, Turkey, India, and European countries. Due to its high demand for copper, China remains one of the most significant export markets for Iranian copper.

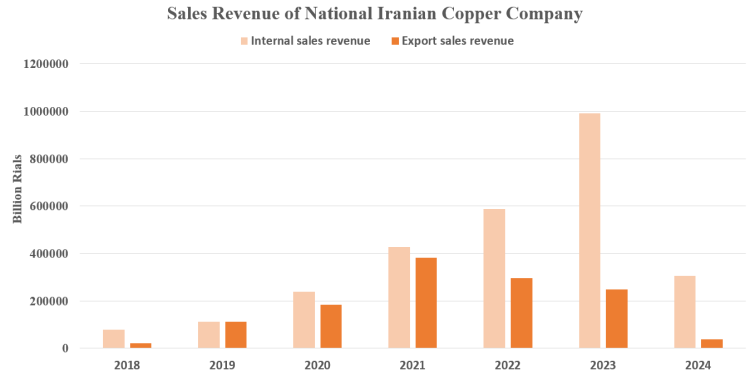

To assess the state of Iran’s copper market, we rely on data from the National Iranian Copper Industries Company (NICICO), the largest company in Iran’s copper industry. In 2024, approximately 20% of NICICO’s revenue came from exports, a significant decrease from 50% in 2020. This decline in copper exports is attributed to the introduction of new export regulations and the disparity between official and free-market exchange rates in Iran.

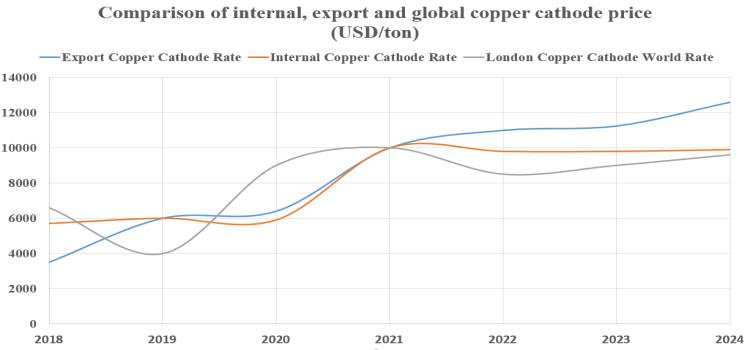

Trends in Global, Domestic, and Export Copper Prices

In recent years, global copper cathode prices have been influenced by global supply and demand, economic fluctuations, geopolitical developments, and exchange rate changes. The economic recovery following global crises, including the COVID-19 pandemic, led to increased demand and consequently a rise in copper cathode prices starting from late 2020. Monetary policies in countries like the United States and Europe, as well as economic conditions in China, have had a significant impact on the prices of base metals like copper.

It is anticipated that with the growing demand for green technologies (such as renewable energy and electric vehicles) coupled with supply constraints, global copper prices will remain relatively high.

To enter the competitive copper market with comprehensive information, it is essential to have an accurate forecast of copper prices. Copper prices prediction provides you with a clear perspective before making transactions and minimizes the risk of capital loss.

Summary

The vast copper reserves in Iran highlight the country’s significant potential to become a global hub for copper production and exports. The high quality and grade of copper from Iranian mines have attracted the attention of international buyers to Iran’s exported copper ingots and cathodes. Analyzing the trends in global copper prices and Iran’s export prices reveals that the close alignment between Iran’s export rates and the London Metal Exchange (LME) copper cathode prices is driven by the increasing demand for copper products manufactured in Iran. However, for Iran to establish itself as a key player in the global copper market, it needs to increase the ratio of production to its copper reserves.